T +352 270448-0

F +352 270448-729

info@feri.lu

18, Boulevard de la Foire

L-1528

Luxembourg

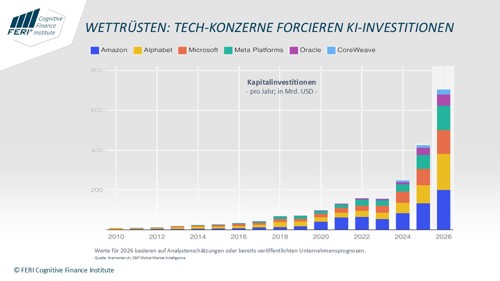

The planned investments of major tech companies in artificial intelligence will reach new record highs in 2026 – significantly above previous forecasts. This not only accelerates the pace of the global AI race, but also increases concerns about irrational exaggerations and growing digital power concentration.

For 2026, the major tech companies in the US are planning capital investments of nearly $700 billion – significantly more than forecast in fall 2025. The focus of this spending is on AI infrastructure, data centers, and specialized chips. Amazon leads the way with US$200 billion, followed by Alphabet with US$175 to US$185 billion.

With the renewed increase in their investment targets, the tech titans are faced with the pressing question of whether these record sums are economically justified – or whether the entire sector is moving ever faster toward an irrational “AI bubble.”

The tech giants must now prove that their trillion-dollar investments in AI capabilities will result in real value creation and future profits. And they must do so in an extremely competitive environment! If they fail to do so, they face the threat of misallocation, margin pressure, and high write-offs. Already, more and more market participants are doubting the long-term profitability of the AI boom.

At the same time, there is a growing risk of digital power concentration, something that the FERI Cognitive Finance Institute has been warning about for some time: if only a few corporations control the central AI infrastructure, this would have far-reaching implications for the economy, politics, and society.

Further insights on this topic are provided in the analysis „Digitale Machtkonzentration: Zunehmende Dominanz und drohende Risiken einer neuen Tech Oligarchie“. It is available in German in the download area on this page.