T +352 270448-0

F +352 270448-729

info@feri.lu

18, Boulevard de la Foire

L-1528

Luxembourg

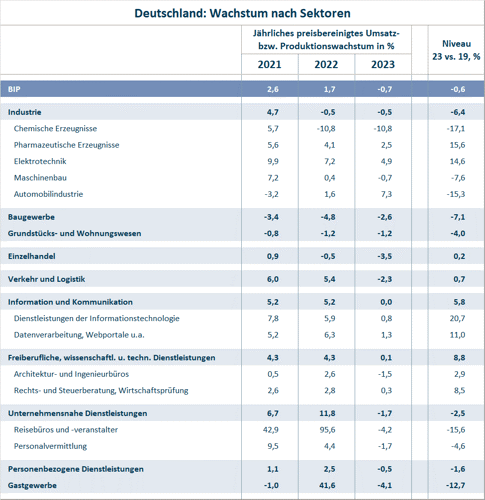

The German economy is in recession at the beginning of 2023, mainly due to the loss of purchasing power as a result of high inflation. In this environment, most sectors will have to prepare for falling price-adjusted sales in 2023. This is particularly true of the retail sector, where the reluctance of households to spend was already noticeable in the final months of 2022. Although declining inflation rates should bring a slight improvement in the course of the year, the bottom line is that price-adjusted sales will shrink by 3.5 percent.

The outlook for industry is mixed: Many companies in the chemical industry already cut back production significantly in the second half of 2022 because some plants became unprofitable as a result of high raw material and energy costs. Whether the gas price brake for companies can halt or even reverse this decline is one of the exciting questions for 2023. Even if the situation improves over the course of the year, chemical production for 2023 as a whole must be expected to fall by more than 10 percent compared with the already weak year 2022.

In the German automotive industry, the outlook for the coming year is not as positive as the expected production increase of more than 7 percent would suggest: This increase is due to the fact that manufacturers will be able to gradually work off their high order backlog thanks to an improving supply of memory chips. Looking ahead, however, vehicle manufacturers will have to brace themselves for worse times ahead, as demand for cars is likely to fall noticeably in the recession, and the strongly export-oriented sector will also have to reckon with headwinds from the global economy. The lower level of subsidies for electric vehicles is a factor that is additionally dampening expectations.

A year ago, we wrote here that the German construction industry could be one of the winners of the change of government. In the meantime, it has become clear that the target of building up to 400,000 new housing units per year will still be missed by a wide margin in 2023. Rising interest rates and high construction costs have led many private developers to abandon their building projects, and public-sector clients are also showing increasing restraint. Commercial construction is also unlikely to see any positive impetus in a recession. Overall, construction output will continue to decline in 2023 following the significant drop in 2022.

The high sales growth of almost 100 percent for travel agencies and tour operators and of more than 40 percent for the hospitality industry in 2022 must be classified against the backdrop of a very low starting level due to the pandemic. In both sectors, sales are thus still significantly below the level of 2019. After the pandemic-related catch-up effects have essentially been completed, the development of private consumption will become the most important determinant of further sales development, and this leads us to expect a decline in price-adjusted sales of around 4 percent in 2023 for both sectors.

The revenue trend in the IT sector and related industries remains positive: Sales of information technology services, like those in data processing and web portals, are more than 10 percent above the level of 2019 and will continue to rise in 2023, albeit at a much slower pace than recently. The fact that Germany is still more on a par with a developing country in terms of digitization continues to open up positive prospects for companies in these areas in principle. For these to materialize, however, more impetus is also needed from the political sphere. More commitment from local and state governments to the digitization of administrative processes and citizen services would be helpful here.

Table: Growth in Germany by sector